Tax Credits 2025 Maryland For Seniors. It could rescue a homeowner from. There are a number of tax credits and tax deductions that will specifically help people who live with disabilities or their caretakers in 2025.

If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland’s maximum pension exclusion of $36,200* under the conditions described in. What is maryland’s state income tax rate?

Tax Credits 2025 Maryland For Seniors Joby Melody, Whether another taxpayer can claim you as a dependent on their tax return;

Tax Credits 2025 Maryland For Seniors Joby Melody, The senior tax credit is a program in maryland that provides a tax credit of up to $1,000 for eligible seniors.

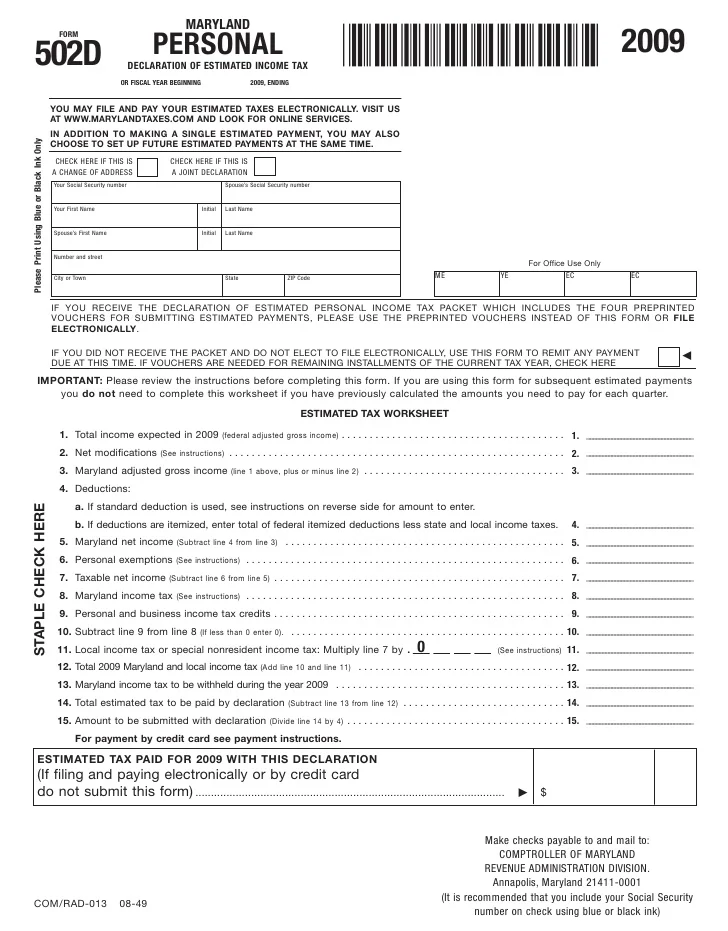

Maryland State Tax Credits for Seniors, Homeowners and Senior Renters, For tax year 2019, maryland's graduated personal income tax rates start at 2.00% on the.

Tax Credits 2025 Maryland 2025 Kara Ronnica, The maryland homeowners' property tax credit is often referred to as the forgotten property tax credit.

2025 Standard Deduction Over 65 Tax Brackets Alysa Bertina, Whether another taxpayer can claim you as a dependent on their tax return;

Tax Credits 2025 Maryland For Seniors Joby Melody, All marylanders who received a homeowners’ or renters’ tax credit in 2025 will be mailed a.

Tax Credits 2025 Maryland Bryn Marnia, All marylanders who received a homeowners’ or renters’ tax credit in 2025 will be mailed a.